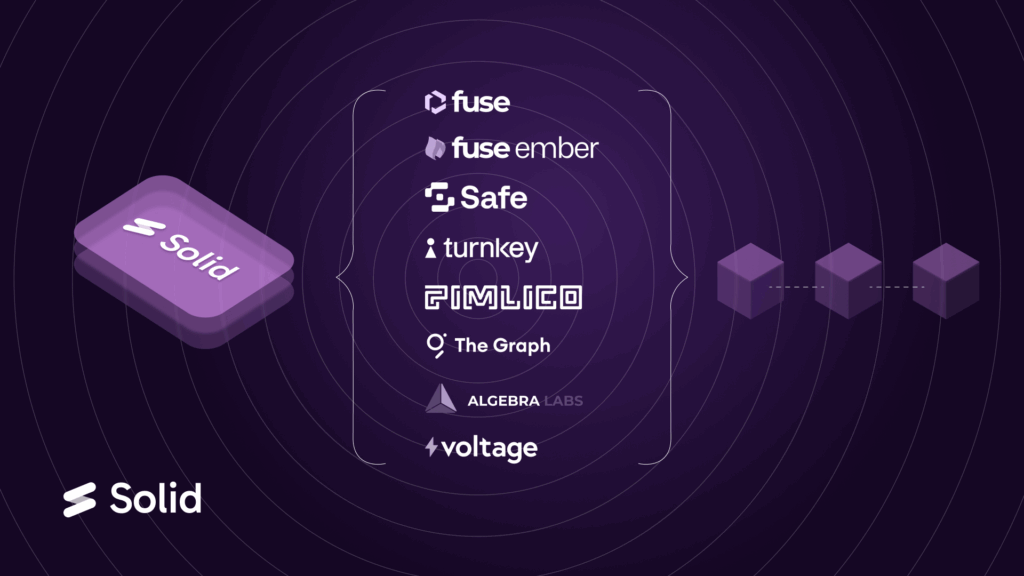

TLDR: Solid runs on the Fuse blockchain to deliver a fintech-grade, self-custodial experience: account abstraction (ERC-4337), gasless transactions, and a yield-bearing stablecoin (soUSD), all powered by a vertically integrated stack (wallets, relayers, DEX, indexing). This post explains what Solid is, and why building it vertically on the Fuse stack (with Voltage DEX) matters.

Create an account today with code: FuseOGS.

Why Solid Is Built on Fuse (and What That Enables)

Most DeFi apps stitch together third-party components, which drives up fees and complexity. Solid is vertically integrated on Fuse, using the chain, accounts, middleware, and trading rails we’ve matured over six years:

- Execution & settlement: Fuse (instant-finality UX) with Ethereum L1 connectivity.

- Accounts: ERC-4337 account abstraction (no seed phrases).

- Middleware: gasless relayers, subgraphs, APIs.

- Trading & liquidity: Voltage DEX (Algebra) + execution partners like Veda.

- Ops tooling: explorers, notifications, indexing, monitoring.

Result: a fast, mobile-first, gasless, self-custodial experience that feels like fintech—without giving up decentralization.

Self-Custody With Account Abstraction (ERC-4337)

Solid replaces fragile key flows and signing fatigue with smart accounts:

- SAFE: multisig-grade smart accounts by default.

- Turnkey: passkeys & biometrics for secure, keyless login.

- Pimlico: paymasters for gasless transactions, bundlers for smooth execution.

No seed phrases or bridge hopping in the UX. Just a modern, self-custodial account that works on web and mobile.

soUSD: Yield-Bearing “Digital Dollars” by Design

At the core is soUSD, Solid’s yield-bearing stablecoin:

- Deposit USDC → mint soUSD.

- Yield is sourced via BoringVaults (curated DeFi strategies). BoringVaults are a DeFi framework pioneered by Veda that uses a barebones, modular vault contract to offload complex functions like deposit management, rebalancing, and yield calculation to specialized external contracts, or “modules”.

- Interest accrues in the exchange rate, no claiming required.

- Composability: use soUSD in swaps, liquidity, collateral, and (soon) real-world spending.

Think of soUSD as shares in a yield-generating vault whose USD value is designed to grow over time as yield accrues.

Key advantages:

- Auto-compounding yield without lockups.

- Real-time accrual reflected in your balance.

- Full transparency: strategies meet strict inclusion criteria (security, TVL, uptime, open withdrawals).

soUSD represents shares in a yield-generating vault. Its USD-equivalent value is designed to grow over time as yield accrues.

Reliability & Cost Efficiency From the Ground Up

Fuse targets B2B2C payments and consumer-grade apps. Therefore, Solid benefits from:

- Reliable vault execution & monitoring in production-ready infrastructure.

- Fast indexing & analytics through clean subgraphs and observable state.

- Wholesale gas economics, so more yield flows back to users.

- Full-stack access to implement custom vault logic and automation.

Beyond Dollars: A Wallet-Native Financial Layer

Solid aims to be a wallet-native financial layer, not just a vault.

- Earn on USDC today; ETH, BTC, and tokenized assets.

- Spend with the Solid Card (coming soon), linking yield or principal to checkout.

- Swap & trade with no gas fees in the UI.

- Leverage via upcoming lending/borrowing and collateral features.

Everything runs through the same self-custodial smart account, while Fuse handles the heavy lifting behind the scenes.

Roadmap Highlights

Looking ahead, Solid will expand along four tracks:

- Asset support: Ethereum, Bitcoin, ETFs, tokenized stocks/commodities.

- Credit features: lending, borrowing, and advanced portfolio strategies.

- Trading & portfolio tools: deeper analytics and seamless management.

- Engagement: quests, points, and referrals built into the app.

The goal is to remove friction and to make finance intuitive and rewarding, with yield as a core building block rather than an afterthought.

Get Started

Solid is built differently because it’s built on Fuse. If you’re building consumer finance or B2B2C payments, Solid shows what’s possible when the chain, middleware, and app are designed together—performance up front, self-custody at the core.

Solid is live. Create your account and try the gasless, self-custodial experience:

- Sign up code: FuseOGS

- What you get: smart account (no seed phrase), soUSD yield, gassless swaps, and a mobile-first UI.

Join the Fuse journey today and help shape the future of payments.

.svg)

.svg)