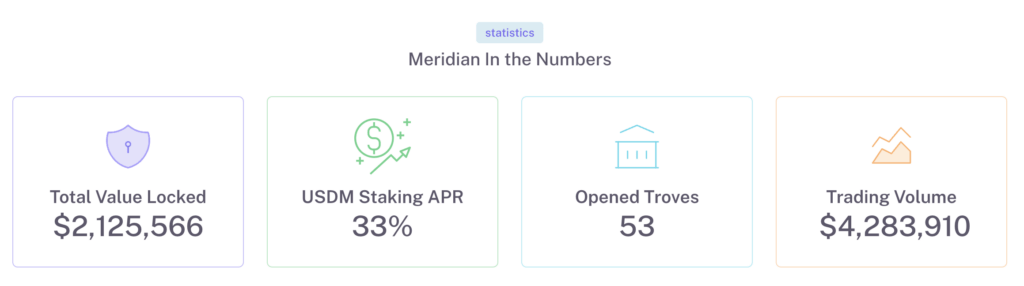

Meridian Finance deploys its USDM stablecoin on Fuse to offer stable yields, trading, liquidity provision, and arbitrage opportunities.

We are pleased to announce a strategic partnership with cross-chain DeFi lending protocol Meridian Finance. Meridian will first deploy Meridian Mint and the USDM stablecoin. Later, Merdian Lend and Trade will be added to reintroduce lending opportunities on Fuse.

Meridian Finance is designed to offer a comprehensive suite of options for DeFi investors, from stable yields to engaging trading strategies, making it a pivotal platform for those looking to expand their DeFi portfolio. Whether you’re an experienced investor or new to DeFi, Meridian Finance provides innovative, profitable, and stable investment strategies.

What you need to know:

- Meridian Finance will deploy its USDM stablecoin on Fuse Network.

- Users can deposit FUSE to mint the USDM stablecoin.

- Users can deposit USDM to earn yields and support USDM’s pegging mechanism, with rewards in FUSE tokens.

- Users can swap FUSE for MST on Voltage and stake MST to earn 100% of the protocol’s fees.

- Opportunities for portfolio diversification through swapping USDM for FUSE and supplying liquidity for the USDM-FUSE pair, earning trading fees.

- Plans to introduce MST to the Fuse ecosystem, allowing staking and earning 100% of protocol fees, enhancing both Meridian Finance’s and Fuse’s value and utility.

- Once all Meridian products are deployed on Fuse, USDM will be used for derivatives trading on Meridian Trade and as collateral on Meridian Lend.

- Join us at 3 PM UTC on 5 March 2024 for a live AMA with the Meridian Finance team.

Meridian Mint

Meridian Mint is a decentralized, non-custodial, governance-free borrowing protocol that enables users to obtain interest-free loans against cryptocurrency collateral, such as FUSE. Loans are paid in USDM, which is a USD-pegged stablecoin.

Meridian adopts an over-collateralized lending architecture that maintains a minimum collateral ratio of 110%, which is algorithmically validated and assured by a Stability Pool to keep the pegged value of USDM.

Meridian shares the same smart contract code base as the highly successful Liquidity Fork protocol. All contracts are thoroughly verified and can be reviewed here on sourcify.

What Can I Do Using Meridian Finance?

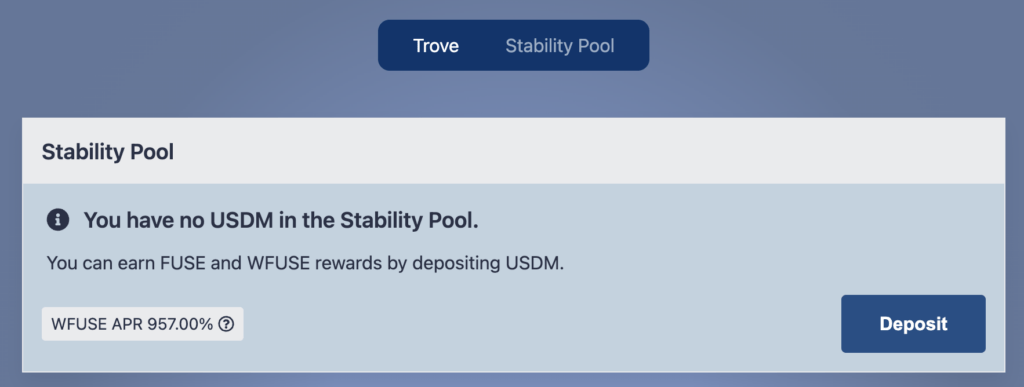

1. Stability Pool Deposits: A Win-Win for Stability and Yield

By locking up FUSE and minting and depositing USDM into the stability pool, users earn attractive yields on a stablecoin and play a crucial role in maintaining the pegging mechanism of USDM.

The rewards for participating in the stability pool come from FUSE tokens provided by Fuse Labs and from liquidating under-collateralized troves. When these troves are liquidated, they burn USDM from the stability pool.

In return, depositors are reimbursed with FUSE tokens and a 10% profit, making it a lucrative opportunity for investors looking for stable yet profitable investments.

2. Swap/Supply LP: Diversify and Profit

Another critical feature is swapping USDM for FUSE on Voltage, allowing users to trade on the price action of FUSE. This provides a straightforward way to diversify your portfolio and opens the door to potentially profitable trading strategies based on the price movements of FUSE.

Furthermore, users can supply liquidity provider (LP) tokens for the USDM-FUSE pair, capturing trading fees. This adds a layer of profitability, as supplying LP not only contributes to the liquidity and health of the trading pair but also rewards users with a portion of the trading fees generated from transactions involving the USDM-FUSE pair.

3. Stake and Earn with MST

Meridian Finance will also introduce its token, MST, to the Fuse ecosystem. This will allow users to stake MST and earn 100% of the protocol’s fees. This development provides an additional revenue stream for MST holders and further integrates Meridian Finance into the Fuse ecosystem, enhancing both platforms’ overall value and utility.

4. Arbitrage Opportunities: Capitalize on Price Discrepancies

Meridian Finance also offers users the chance to engage in arbitrage opportunities. When USDM trades below or above its pegged value of $1, savvy investors can buy low and sell high, or vice versa, to capitalize on these price discrepancies.

This requires a keen eye and a good understanding of market dynamics, but arbitrage can be a highly profitable venture for those up to the challenge.

Looking Ahead:

Deploying Meridian Mint and the USDM stablecoin is stage one of this partnership. This collaboration aims to enhance Total Value Locked (TVL) on Fuse by offering lending and trading opportunities, which fosters liquidity, investor confidence, and growth within the decentralized finance (DeFi) ecosystem.

Lending & Trading

Once all Meridian products are deployed on Fuse, USDM will be used for derivatives trading on Meridian Trade and as collateral on Meridian Lend.

The impact of lending on a blockchain’s Total Value Locked (TVL) is multifaceted and significant, reflecting a dynamic interplay between liquidity provision, investor confidence, and the overall growth of the decentralized finance (DeFi) ecosystem on Fuse. We will keep the community posted as the complete integration with Meridian Finance unfolds.

Ready to Dive Into Meridian Finance?

Navigating the options available on Meridian Finance might initially seem daunting, but the potential rewards are well worth the effort. Whether you want to earn stable yields, engage in trading and liquidity provision, or capitalize on arbitrage opportunities, Meridian Finance offers a comprehensive suite of options to enhance your DeFi portfolio.

Platforms like Meridian Finance are paving the way for innovative, profitable, and stable investment strategies. Whether you’re a seasoned investor or new to the space, exploring what Meridian Finance offers could be the next step in your financial journey.