Fuse Network has been added to the list of chains that Multifarm is tracking. Multifarm enables users to compare yields on over 1000 DeFi protocols across 25 chains to find the best opportunities.

Thousands of decentralized finance applications span multiple blockchains, vying for eyeballs and all-important liquidity. In today’s fast-paced world, yield farmers can have a tough job staying abreast of all the opportunities.

DeFi Yield Data Aggregator, and More

Multifarm is a popular yield farming dashboard that essentially provides a one-stop shop where visitors can search through more than 1000 farms across 25 blockchains, with more added regularly. The platform curates data, enables investments, and ultimately helps users maximize yields. The core team comprises experienced DeFi players and yield hunters united to solve the common problem of efficiently finding the best platforms and yields in an increasingly crowded market.

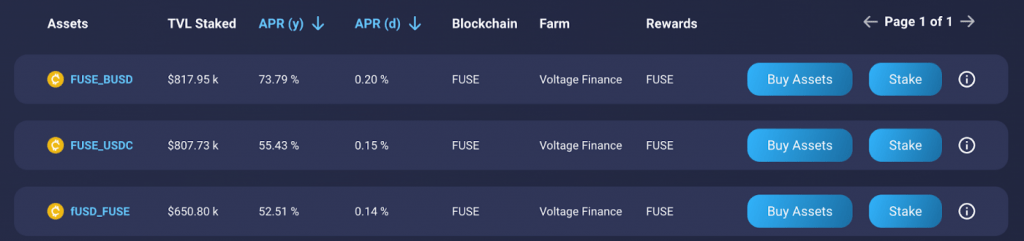

Vital data such as historical APR and TVL on farms and assets lets yield hunters thoroughly research before investing. With advanced search parameters such as search by yield type (single, LP, staking, lending, etc.), or by liquidity higher than X amount, APR higher than X percentage, or parameters such as harvest lockup or transfer tax. Multifarm simplifies the process of finding a suitable yield for all types of investors. Additionally, Multifarm produces data-driven insight and reporting on the state of DeFi to guide users further.

Multifarm also aggregates information about the various bridges connecting various chains. A user wishing to find out about the bridges that can take their assets from a given chain to another one and the fees that they require can use the Bridges interface of the Multifarm app.

How Multifarm Integrates Fuse

Now Multifarm has integrated Fuse DeFi dapps; Fuse token holders have a faster and far more straightforward way to track all yield farming opportunities available on-chain and decide where to get the best return on their investments.

Currently, four platforms provide yield farming opportunities on the Fuse Network. Clicking on Voltage Finance leads to a list of seven farms on that specific platform where users can instantly rank by APR, for example. The daily APR percentage is handy so investors can calculate earnings over more precise time frames.

Using Multifarm, Fuse holders and the wider community can now scan through all Fuse’s yield farming and passive income opportunities in one place. Moreover, it places Fuse Network dapps and earning opportunities in front of Multifarm’s community of users.

As more DeFi and exchange dapps arrive on Fuse with additional earning opportunities for users, it is vital to have a central information hub and streamline operations for busy investors. The integration of Fuse into Multifarm allows users to earn a passive income with their digital assets and, more importantly, take action when an opportunity arises.

Follow our social media channels to stay updated on recent news and developments at