Monerium will be placing regulated fiat money on Fuse’s low fee, high throughput blockchain in order to offer micro-economies a payment solution that is scalable, frictionless and cost-effective.

Can we leapfrog open banking?

The term “open banking” broadly refers to the use of APIs that allow third-party developers to build applications and services around existing financial institutions; fostering innovation in online and mobile payments.

However, through the open banking initiative, institutions are forced to work together on legacy infrastructure that is siloed and, in many cases, incompatible with the products and services that innovators really wish to build.

With public, decentralized blockchains the underlying technology is made accessible so that any innovator can build their services using code and open standards.

Money comes to micro-economies on blockchain

Our new partner Monerium helps customers move euros, dollars and sterling between bank accounts and their blockchain addresses. Monerium is an Electronic Money Institution (EMI), which is licensed to operate in the European Economic Area (EEA) and the UK. The platform issues asset-backed, regulated, and redeemable fiat money to blockchains.

This new partnership means that entrepreneurs and community leaders who launch micro-economies on Fuse are able to make use of all the features that major currencies like the euro provide, including stability and acceptability, whilst also benefiting from the empowering open-source attributes of blockchain.

How does it work?

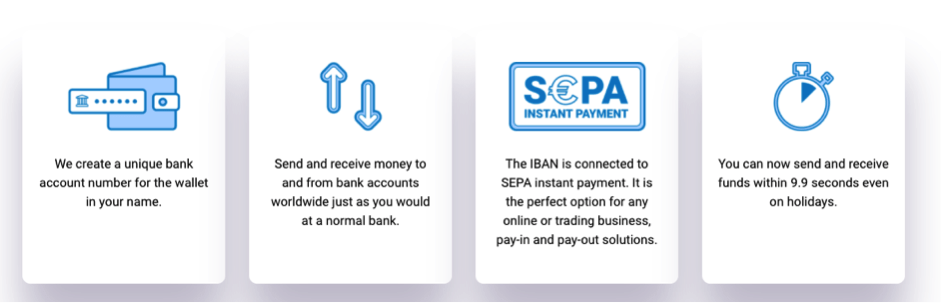

Customers that qualify for an account with Monerium are able to create a new international bank account number (IBAN) that is directly connected to a blockchain address in their preferred blockchain wallet e.g. the Fuse wallet or MetaMask.

The money is issued as tokenized electronic money (or e-money tokens) to the blockchain address once payment is received in the IBAN account. E-money is a proven form of digital currency that is safer than bank deposits. The e-money token complies with the ERC20 standard and therefore is natively supported by all leading blockchain wallets.

Unlike stable coins, e-money on the blockchain is unconditionally redeemable at any time with no need for counter party demand on exchanges, it is simply transferred directly to bank accounts.

Wikibank use-case: Boosting local economies and feeding disadvantaged neighbourhoods

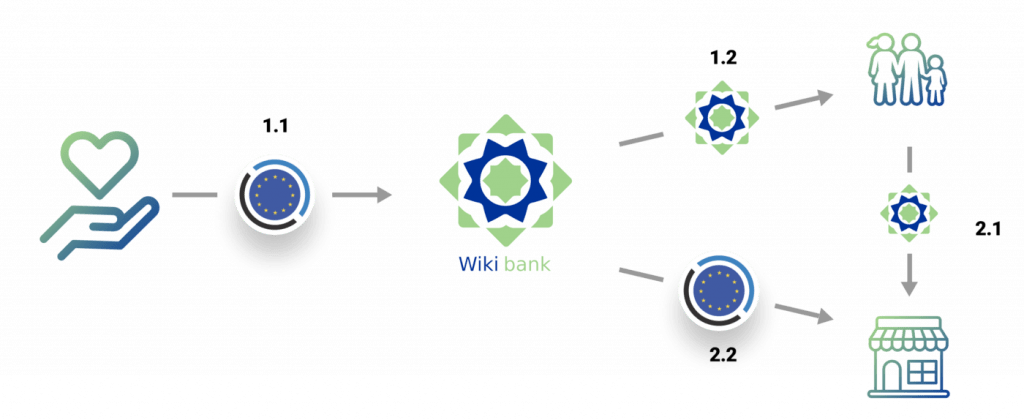

Our first pilot will involve Wikibank, an existing community built on Fuse that provides blockchain token-based grocery vouchers to those most in need in Seville, Spain. This integration allows us to create a complete end-to-end asset flow:

1. Donation and distribution of Wikibank grocery vouchers

- Charities send euros to Wikibank’s Monerium IBAN from a bank account. The euros are automatically issued to Wikibank’s blockchain address that holds the funds to be paid to merchants.

- Wikibank grocery vouchers are minted on the blockchain, one for every euro donated. The new vouchers are then distributed to persons in need who have the Wikibank wallet application installed on their mobile device.

2. Food purchased from local merchants

- The persons then buy groceries with the Wikibank grocery vouchers from local participating merchants using the Wikibank wallet application.

- Merchants exchange the Wikibank grocery vouchers for euros from Wikibank’s blockchain address which are sent to the merchant’s bank account.

Fuse and Monerium are offering micro-economies and communities like Wikibank something much more than just a faster and cheaper way of doing things.

- Charities can donate money knowing that they have complete transparency of the flow of funds and that money is spent on food and nothing else. It’s impossible to spend the tokens multiple times. It’s a system that is considerably easier and faster to set up for all parties involved.

- Merchants can accept payments in grocery vouchers and have money automatically sent to their bank account. The only requirement is their existing smartphones, no extra payment hardware or system integration required.

- Charities and merchants do not have to hold or exchange cryptocurrency or stablecoins. The euros are seamlessly integrated between bank accounts and blockchain wallets using the Monerium platform.

- Food tokens are easily distributed to families in need. They can choose where they buy food and do not have to spend everything in one place. They do not have to wait in food lines, they can help the local merchants and feed their family at the same time.

- Charities and governments can boost and aid certain sectors to create a fair and thriving economy.

Creating a thriving micro-economy

European governments, charities, businesses or community leaders that want to learn more, launch or participate in these emerging micro-economies with euro, dollars or sterling can head to monerium.com to find out more.