We are thrilled to announce that lending is back on the Fuse Network with the launch of the Meridian Lend protocol. This addition brings a robust and versatile decentralized lending solution to the Fuse ecosystem, enhancing both liquidity and financial flexibility for users.

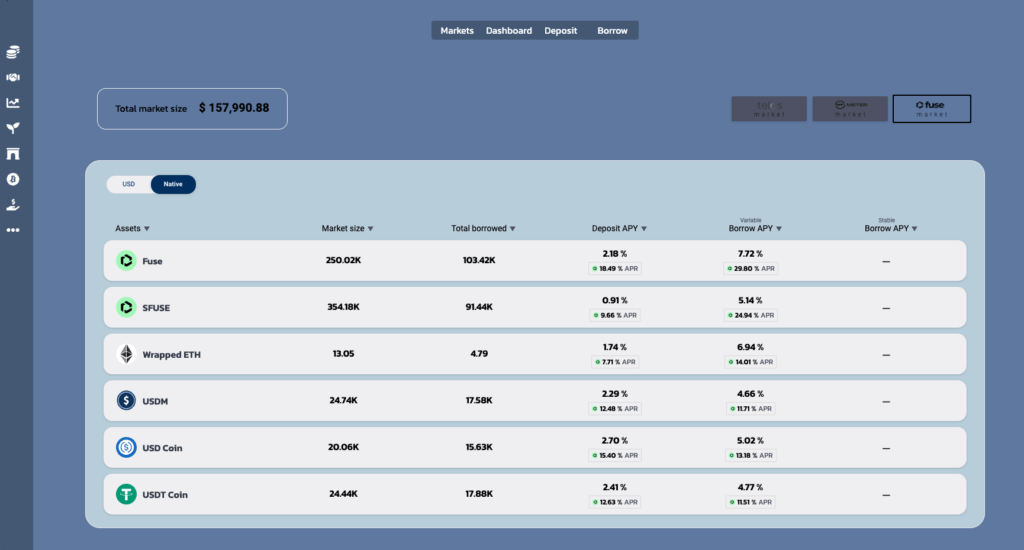

With the launch of Meridian Lend, users on Fuse Network are able to borrow and deposit crypto assets on Fuse network to earn interest on a wide portfolio of tokens, including FUSE, sFUSE, USDM, USDC, USDT, and WETH tokens. Lenders to the protocol will benefit from receiving their rewards in the same tokens as they deposit. Lend USDC, earn USDC.

Key Takeaways:

- Meridian Lend is now live, offering decentralized, non-custodial lending on Fuse.

- Users can leverage several assets, including FUSE, sFUSE, USDM, USDC, USDT, and WETH tokens, further enhancing their investment strategies.

- The protocol is built on the proven technology of Aave, ensuring security and confidence.

- Opportunities for both “long” and “short” strategies are available, providing users with flexible trading options.

- Additional rewards are currently available for borrowing, making it an excellent time to explore leverage options on Merdian Finance.

About Meridian Finance & Lending Protocol

Meridian Finance is a comprehensive DeFi trading platform that offers interest-free stablecoin lending, leverage trading, and zero-slippage swaps. It is designed to cater to both novice and experienced investors with its user-friendly interface and a wide range of financial tools. Meridian enables users to maximize their DeFi strategies efficiently, ensuring security, profitability, and stability.

Learn more: https://www.meridianfinance.net/

Meridian Lend protocol provides a decentralized, non-custodial lending service where users can deposit whitelisted assets to earn interest or take out overcollateralized loans. This system is designed with high security in mind, featuring smart contracts that are audited and based on Aave’s trusted framework. The protocol offers transparent risk management and a straightforward process for both depositing and borrowing.

Meridian Lend dApp: https://lend.meridianfinance.net/markets

Learn more: https://docs.meridianfinance.net/lending

Note: Before starting with Merdian lend, you would need some assets on Fuse network first. To bridge assets over to the Fuse network, users can utilize the power of the Fuse Console Bridge, powered by LayerZero.

How to get started with Meridian Lend

Below are some guides and resources that will get you started borrowing and lending on Fuse network using Meridian Lend protocol.

- How to bridge assets to Fuse using the Fuse Console bridge:

2. How to lend and borrow assets on Meridian Lend:

- How to deposit on Meridian Lend: https://docs.meridianfinance.net/lending/depositing

- How to borrow on Meridian Lend: https://docs.meridianfinance.net/lending/borrowing

3. How to get sFUSE tokens through liquid staking on Voltage DEX.

Popular Leveraging strategies using Meridian Lending

Meridian Lend offers unique opportunities for leveraging you asset positions, especially with sFUSE tokens. Users can deposit sFUSE as collateral to borrow FUSE, which can then be staked or swapped, amplifying their investment capacity.

Here are some popular examples of how you can maximise utility of your assets on Meridian Lend protocol:

How do I leverage my sFUSE Position?

- Deposit sFUSE as collateral.

- Borrow FUSE and then stake or swap it for more sFUSE.

- Redeposit the additional sFUSE to further boost your earnings.

- Repeat the process to enhance returns.

How Can I Use Meridian Lend to Take a ‘Long’ on FUSE?

- Use sFUSE as collateral to borrow stablecoins.

- Purchase FUSE with the borrowed stablecoins.

- This strategy effectively leverages your position by increasing your exposure to FUSE, betting on its value increase.

How Can I Use Meridian Lend to Take a ‘Short’ on FUSE?

- Provide non-FUSE assets as collateral.

- Borrow FUSE and immediately convert it to a stablecoin or another asset.

- Repurchase FUSE to repay the loan when you believe its price will drop, securing a profit on the price difference

By harnessing the Meridan Lending protocol, users can enhance their financial strategies and leverage their holdings to optimize returns. As we continue to expand and improve our offerings, Meridian Lending remains committed to empowering our community with the tools they need to succeed in the dynamic world of decentralized finance.

Follow our social media channels to stay updated on recent news and developments at: