The Fuse token is the native token of the EVM-compatible Fuse blockchain. There are several centralized and decentralized exchanges listing Fuse. This guide will show you how to get Fuse, which exchanges have the best rates, and how to leverage your assets through on-chain staking.

Navigating the complicated crypto landscape can be a challenge without the correct information, and more importantly, newer users can fall into countless pitfalls while getting crypto tokens. Therefore, before diving into how to get Fuse tokens, it’s essential to understand a few things and vital to do your research.

Firstly, Fuse lives on multiple blockchains, including Fuse, Ethereum, BNB Chain, Polygon, and Arbitrum One, so having the correct contract addresses for those assets is essential.

Enabling different versions (wrappers) of FUSE on other chains is one way to ensure the growth of the network. It also provides interoperability with significant blockchains with extensive user adoption, which means you can hold and send Fuse on various blockchains.

From a cost perspective, fees on Ethereum (Approx $5/10 at writing) mean getting Fuse on Ethereum is the most expensive route. On the other hand, getting Fuse on Fuse is the lowest cost option, while each centralized exchange will require KYC and new account creation. Of course, if you already have an account at one of the centralized exchanges listing Fuse – that may be the fastest route.

The ideal scenario for anyone wanting to get Fuse tokens is already having a blockchain wallet like MetaMask and an account set up. You can then interact with trusted decentralized protocols like UniSwap.

Fuse token utility

The Fuse Network token is the primary currency for paying network fees when sending transactions but has a wealth of other utilities within the Fuse ecosystem, including,

- Validation: Token holders can stake FUSE to become a validator. The minimal staking requirement is 100K FUSE. While the network is continuously growing, currently, there are 60+ validators.

- Voting: Validators vote on protocol changes with their staked FUSE and with the tokens delegated to them by stakers. This means validators with higher amounts of Fuse staked can have a more significant vote on network upgrades and governance changes.

- On-chain staking: Any FUSE holder can choose one or more validators to delegate any amount they wish. They receive a share of the Fuse block rewards proportionate to the share of their stake in the total stake, minus the minimum 15% fee paid to the validator(s).

- Payments: As FUSE is the native currency on Fuse Network, sending it does not require interactions with smart contracts. Thus, FUSE transfers are potentially faster and less costly regarding transaction fees.

Having already onboarded countless real-world businesses and Web3 projects to build on Fuse, the project enters a new growth phase. The recent release of an updated White Paper and 2023 Technical Roadmap outlines a vision for Fuse that makes them a significant player in the Web3 payments landscape and go head to head with Visa.

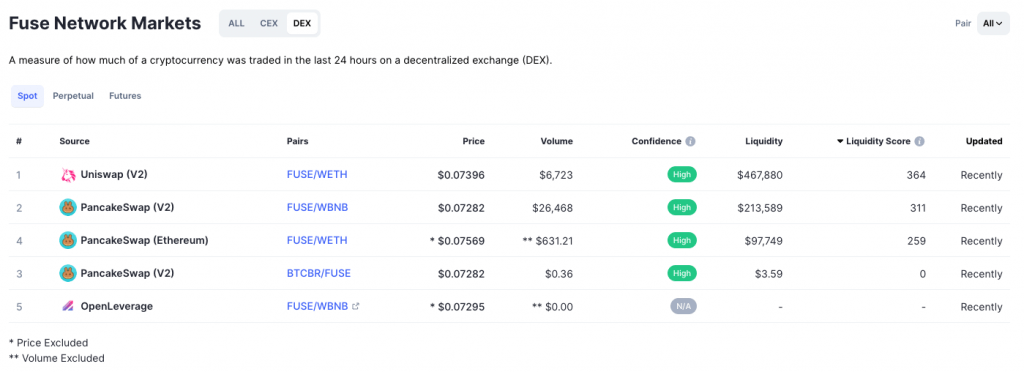

Get Fuse on Decentralized Exchanges

PancakeSwap, 1inch, and UniswapV2 are the top decentralized exchange choices for getting Fuse. With almost half a million dollars in liquidity on the Ethereum-based Uniswap V2, this represents the best option with the slightest chance of slippage. On the other hand, PancakeSwap and 1inch are multichain and offer token swaps on Ethereum, Polygon, and BNB Chain.

Fuse is available on different networks. If you get it on UniswapV2, you will get the wrapped Ethereum version of Fuse. If you get it on PancakeSwap, you can get the wrapped BNB Chain or Ethereum versions. If you get it on Quickswap, you will get the Matic version. All are like-for-like, so it’s a preference where to hold it.

To get Fuse tokens on Fuse Network, use the networks leading DeFi dApp Voltage Finance. This relies on having tokens on Fuse Network in MetaMask, such as USDT or USDC, to make the trade. Alternatively, you can get it on UniswapV2 or PancakeSwap, then send your Fuse from one of these networks to Fuse using the Voltage Bridge.

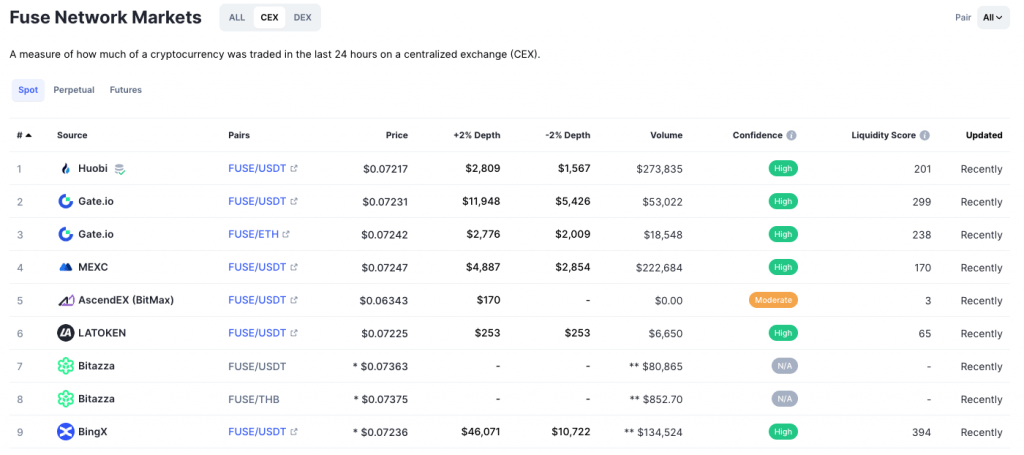

Get Fuse on Centralized Exchanges

When getting Fuse on centralized exchanges, Huobi, Gate.io, and MEXC Global have the deepest liquidity and offer the best routes. Other options are available and shown below.

An important note is that if you choose to hold Fuse on a centralized exchange, you must know that you are not in the custody of those assets, and the exchange is holding them on your behalf in a wallet. Your assets could be frozen if the exchange has a liquidity issue.

Another option is to transfer your Fuse tokens from the centralized exchange account to your blockchain wallet so that you can take full custody.

Stake Fuse

Fuse token holders can participate in securing and governing the Fuse Network by simply staking FUSE tokens without running a validator node or acquiring technical knowledge, most notably, in exchange for rewards. On our dedicated staking page, you can participate in network governance and security by staking tokens to earn an annual percentage yield (APY).

At writing, APY is 14.1%. So if you staked $1000 worth of FUSE tokens, you could earn around $150 in passive income after one year.

If you hold FUSE tokens on another Network, such as Ethereum or BNB Chain, you must first bridge them to Fuse Network. Voltage Finance can facilitate this process quickly with a complete guide on how to do it here.

Fuse staking is 100% on-chain, meaning it’s just you and a staking smart contract. The primary benefit of staking FUSE is that you earn more FUSE, while interest rates are superior. So it’s a potentially profitable way to invest your capital.

.svg)

.svg)